Which European nations tax vehicles the most and the least?

Which European nations tax vehicles the most and the least?

In Europe, there is a great deal of variation in car taxes, with several nations placing a strong emphasis on environmental issues. Euronews Business examines car pricing in four distinct categories, both before and after taxes, using data from the OECD.

Governments have historically derived a large portion of their income from taxes related to the acquisition, registration, and usage of automobiles. In order to affect consumer behavior with regard to energy and the environment—especially with regard to the recent shift to net-zero greenhouse gas emissions—taxation is being employed more and more.

When purchasing a new car, the amount and structure of taxes might differ significantly throughout Europe. These taxes may include sales tax, excise duties, value added tax (VAT), and other fees and levies.

When purchasing a new car, consumers in the majority of UE nations pay either 20% or 21% VAT. Only six nations have a VAT rate higher than 23 percent.

The fundamental cause of the notable differences in car pricing across Europe before and after tax is not the rate of value-added tax. This is mostly due to additional taxes, fees, and bonuses. It is more beneficial to compare the price before tax and the total price, which includes all taxes and levies, rather than simply the VAT rates.

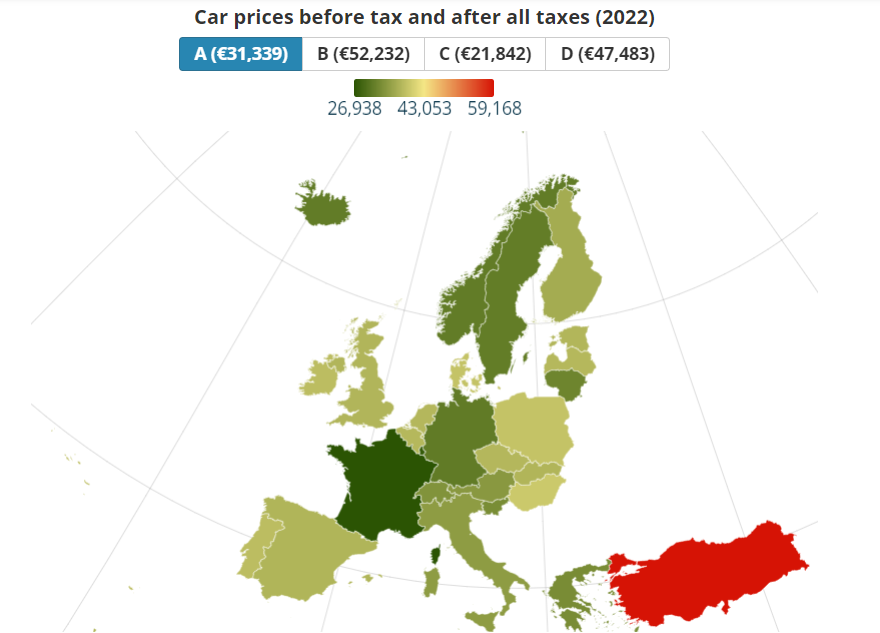

Based on the Consumption Tax Trends 2022 report from the Organisation for Economic Co-operation and Development (OECD), we may examine the costs of a few standard cars that fall into four categories: electric, hybrid, and combustion engines.

SUV/Hatchback electric engine with 150 KW (204 hp) of power, 58 kWh of battery capacity, 17 kWh of consumption per 100 km, weight of 1730 kg, zero grams of CO2 emissions per kilometer, and a battery range of more than 400 km are the specifications of Category A (for example, Volkswagen ID3 performance).

In the simulation, the cost of a Category A vehicle in 2022 was $33,000 (€31,339) before taxes. The price ranged from €26,938 in France to €59,168 in Turkey when taxes were taken into account.

Final cost cheaper than the French and German pre-tax prices

The final price was lower than the price before taxes in Luxembourg (€27,732), Germany (€31,295), and France (€26,938), indicating the extent of bonuses in these three nations. The “green bonus” allowed consumers in France to purchase Category A cars for €4,400 less than the pre-tax price.

Turkey was first, followed by Denmark (€39,174), Poland (€39,801), and Hungary (€39,801).The OECD report states that there were no taxes or fees paid by citizens of Norway. Individuals in Iceland and Sweden, the other two Nordic nations, paid taxes totaling less than €100.

When purchasing a Category A car in Lithuania, Greece, Slovenia, or Switzerland, the taxes were less than €3,000, with the car costing €33,339 before taxes.

Taxes on a vehicle with a larger battery and electrical capacity

In the scenario, Category B cars have more power and battery capacity. The features include a sedan electric engine with 370 kW (496 hp) of power, an 82 kWh battery, consumption of 15 kWh per 100 km, weight of 1830 kg, zero grams of CO2 emissions per kilometer, and a battery range of more than 400 km (sample Tesla Model 3 Long Range Dual Motor).

The ultimate price ranged from €52,009 in France to €98,163 in Turkey when the price in Category B was €52,232 ($55,000) before taxes. This automobile was purchased in Turkey for €46,831 with taxes.The ultimate cost was lower than the pre-tax price in France and Luxembourg because both countries promoted zero-emission cars (ZEVs).

Hybrid car taxes

Hybrid car taxes

Sedan hybrid electric/fuel engines with a 1.8-liter cylinder capacity, 121 kW (162 hp) of power, 95-98 RON unleaded gasoline, 4.5 l/100 (combined) of consumption, and an electric engine with 53 kW (71 hp), 1.3 kWh of battery capacity, 1 800 kg of weight, 115 g/km of CO2 emissions, a battery range of less than 10 km, and 3 mg/km of NOx emissions are the specifications for the Category C sedan hybrid engines (e.g., Toyota Corolla Hybrid LE).

In the simulation, the price before tax was €21,842 ($23,000). In this instance, the total cost, including all taxes, varied between €46,393 in Turkey and €21,494 in Germany.

In seven countries, taxes are more than twice the pre-tax price.It was evident that cars with combustion engines paid the highest taxes. In seven of the twenty-seven European countries, the tax amount was more than twice the price without tax.In 2022, the final costs that consumers had to pay to purchase a Category D vehicle for €47,483 before tax were as follows: €179,297 in Turkey, €146,716 in Denmark, €122,820 in the Netherlands, €117,759 in Norway, €105,898 in Finland, €96,519 in Iceland, and €95,599 in France.

People in the Nordic region paid the highest prices for combustion engine automobiles, with the exception of Sweden, where the ultimate price was €59,354.

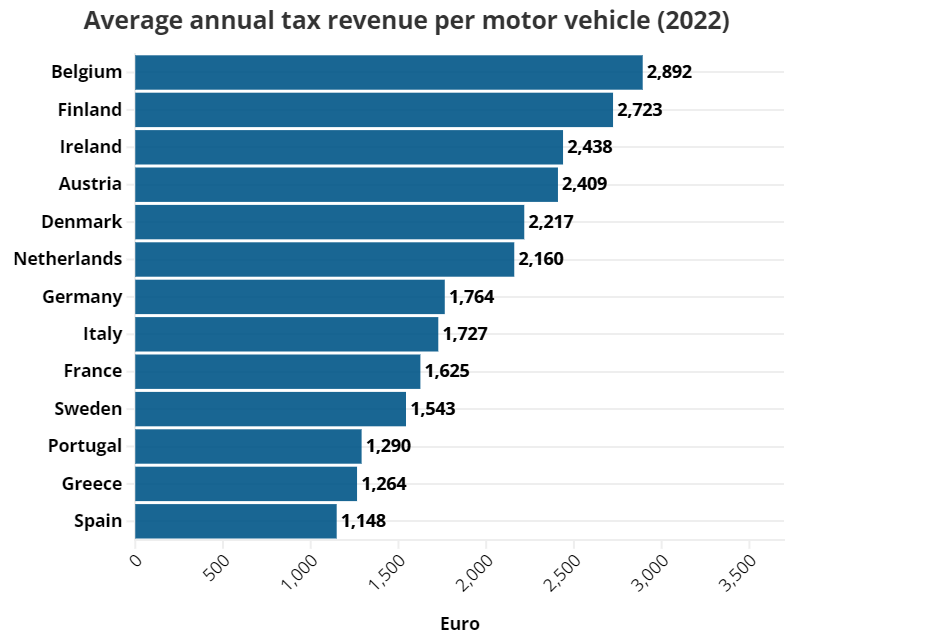

Almost €400 billion in car taxes had been collected in 13 EU nations.

The graphic above shows that thirteen EU countries owe €374.6 billion in tax income to motor vehicles.This amount comprised annual ownership taxes, sales and registration taxes, and—above all—fuel and lubricant taxes.